In that method, inventory is valued at either historical cost or market value, whichever is lower. If we are not able to determine the market value, NRV can be used as a proxy for that. Net Realisable Value accounts for the total value of the asset in terms of the total amount it would receive after-sale and subtract selling costs.

This is, of course, because companies set selling prices higher than their costs to manufacture or purchase something so that they can make a profit. Further, the open market selling price is usually so much higher than the book value that, even after deducting the costs to get ready for sale, NRV is higher than book value. This is especially true during inflationary periods and for high-margin items. However, factors like obsolescence or increasing competition can sometimes push down the open market selling price, making an NRV adjustment necessary. The expected selling price is calculated as the number of units produced multiplied by the unit selling price. This is often reduced by product returns or other items that may reduce gross revenue.

What can NVM tell you about your business?

As economies thrive, clients often have more money at their disposal and are able to pay higher prices. Alternatively, when the economy is down, clients may pass on orders or find it more difficult to make full payments. Now that you understand the importance of NRV let’s look at exactly how you calculate it.

Lordstown Motors Reports Fourth Quarter and Fiscal Year 2022 … – Investor Relations Lordstown Motors Corp.

Lordstown Motors Reports Fourth Quarter and Fiscal Year 2022 ….

Posted: Mon, 06 Mar 2023 08:00:00 GMT [source]

In this article, we’ll define what NRV means, its importance, use cases, and how to calculate it and provide some examples to make it easier to understand. Get up to date on the latest credit control insights and find out what’s been happening at Chaser. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

Inventory

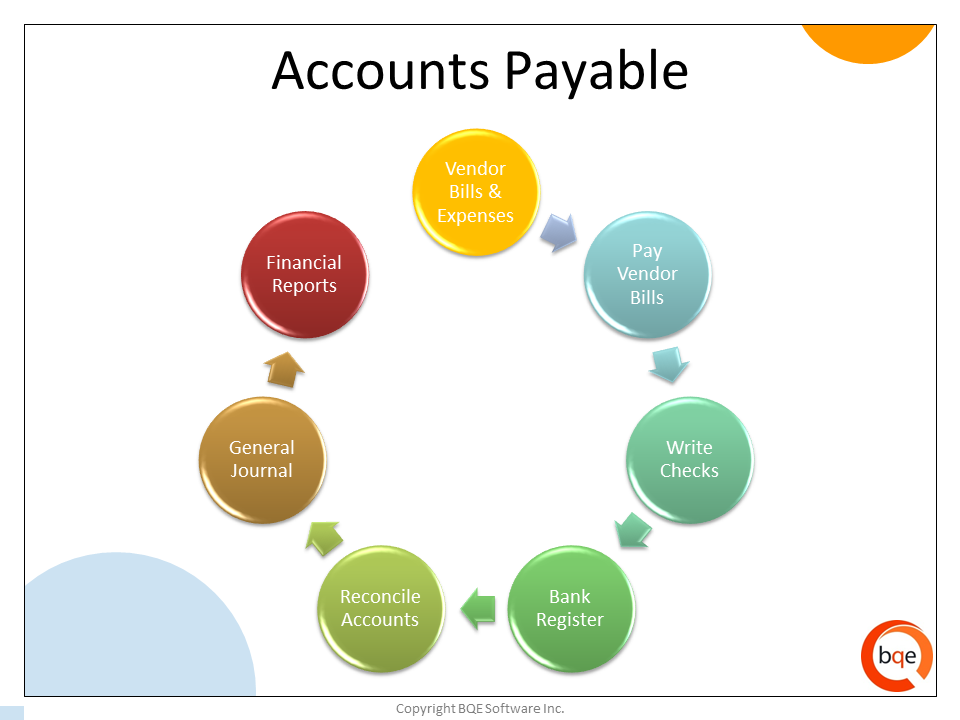

It states that inventory should be valued at the lower of historical cost or current market price. The market floor is the item’s NRV minus the normal profit received from the sale of the item. This is the meaning of an accounts receivable balance presented according to U.S. The difference between reported and actual figures is most likely to be inconsequential. Once again, though, absolute assurance is not given for such reported balances but merely reasonable assurance. Net Realisable Value meaning is the total estimated selling price of market goods subtracting the disposal or sale expenses.

Can NRV be negative?

A positive NRV means that your inventory will earn you profits, while a negative NRV indicates that your product isn't as valuable as the costs it incurs.

In the context of inventory, net realizable value is the expected selling price in the ordinary course of business minus any costs of completion, disposal, and transportation. However, the net realizable value is also applicable to accounts receivables. For the accounts receivable, we use the allowance for doubtful accounts instead of the total production and selling costs. If this calculation does result in a loss, charge the loss to the cost of goods sold expense with a debit, and credit the inventory account to reduce the value of the inventory account.

How to Calculate the NRV

But when a next-generation processor is released, the expected selling price of those PCs is likely to decline. So, the company performs an NRV analysis to compare the inventory’s value on the company’s balance sheet with its estimated NRV. If NRV is lower than the book value, the value of the PC inventory is written down and a loss from NRV is recorded on the income statement directly or as an increase in cost of goods sold. Because of accepted conservative accounting practices, a potential gain — i.e., in the event that estimated NRV is greater than book value — would never be recorded under U.S.

Let’s take an example to understand the calculation of Net Realizable Value formula in a better manner. A large company like Home Depot that has a consistent mark-up can reasonably estimate ending inventory. Home Depot undoubtedly uses a more sophisticated version of this calculation, but the basic idea would be the same. Overdue payments can cause challenges for businesses and deeply affect any business’s cash flow. Using NRV to track customer payment behaviour is just one part of a larger credit control strategy.

What Is Net Realizable Value? How to Calculate and Examples

If appropriate decisions are to result based on this information, both the preparer and the reader need an in-depth knowledge of U.S. Company X is expecting what is a good liquidity ratio that if they sell that machine today, they will get $5000 for that. But they have to go through a middle man which will charge $100 as it cost.

Is NRV the same as profit?

One very important thing that you must realize at this point, though, is that NRV and profit are not the same. We have already said that NRV is the selling price of an item minus any costs associated with selling that item. Profit is the amount of money that is made in excess of the purchase cost of an item.